Understanding the inflation rate in the US is crucial not only for economists but for everyday citizens who feel its effects in their daily lives. Inflation impacts purchasing power, cost of living, and overall economic health, making it a pivotal economic indicator. In recent years, the US has seen fluctuating inflation rates, influenced by various factors ranging from global economic conditions to domestic fiscal policies.

The inflation rate in the US reflects the annual percentage change in the price level of goods and services, as measured by the Consumer Price Index (CPI). When inflation is moderate, it is generally seen as a sign of a growing economy. However, if it becomes too high or too low, it can signal economic troubles, prompting intervention from policymakers and affecting interest rates, wages, and savings.

In this detailed article, we will explore the intricacies of the inflation rate in the US, examining historical trends, current statistics, and future predictions. We'll delve into the causes and consequences of inflation, its impact on various sectors, and the strategies employed to manage it. This comprehensive guide will equip you with the knowledge needed to understand the complex dynamics of inflation in the US economy.

Read also:Ultimate Guide To Nfl Game Pass Everything You Need To Know

Table of Contents

- History of Inflation in the US

- What is Inflation?

- What Causes Inflation?

- How is Inflation Measured?

- Current Inflation Trends

- Impacts of Inflation on the Economy

- How Does Inflation Affect Consumers?

- How Does Inflation Affect Businesses?

- Inflation and Investment Strategies

- How is Inflation Controlled?

- Future Predictions for Inflation Rates

- Inflation and Government Policy

- Inflation in the Global Economic Context

- Frequently Asked Questions

- Conclusion

History of Inflation in the US

The history of inflation in the US is a tale of economic evolution, marked by periods of stability and volatility. Over the past century, the US economy has weathered significant inflationary periods, such as the post-World War II era and the late 1970s and early 1980s. These periods were characterized by double-digit inflation rates, driven by factors like government spending, supply shocks, and changing monetary policies.

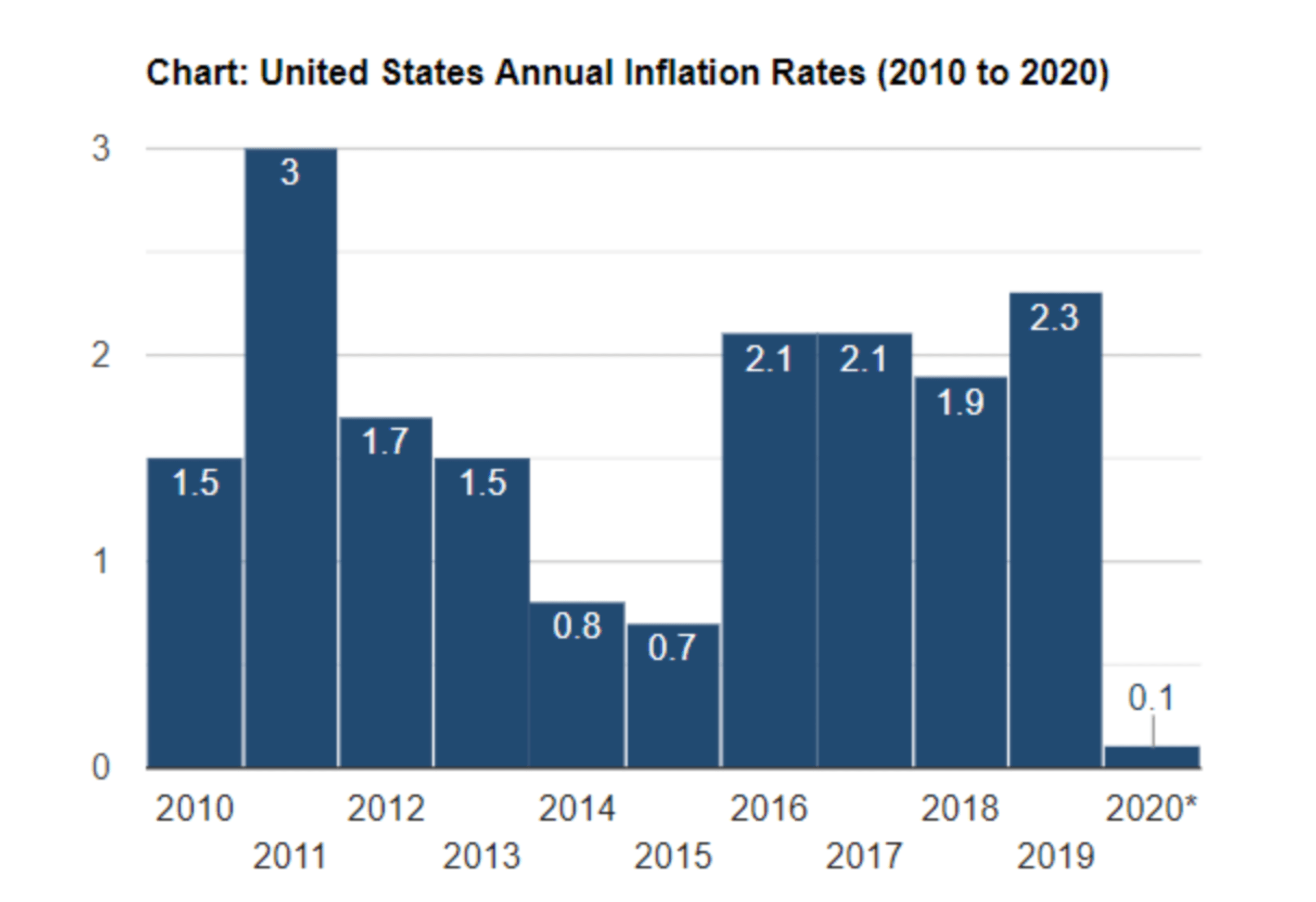

In contrast, the late 1990s and early 2000s saw relatively stable inflation, with rates hovering around the Federal Reserve's target of 2%. This period of stability was achieved through a combination of prudent monetary policy and favorable economic conditions, including technological advancements and globalization, which helped keep production costs low.

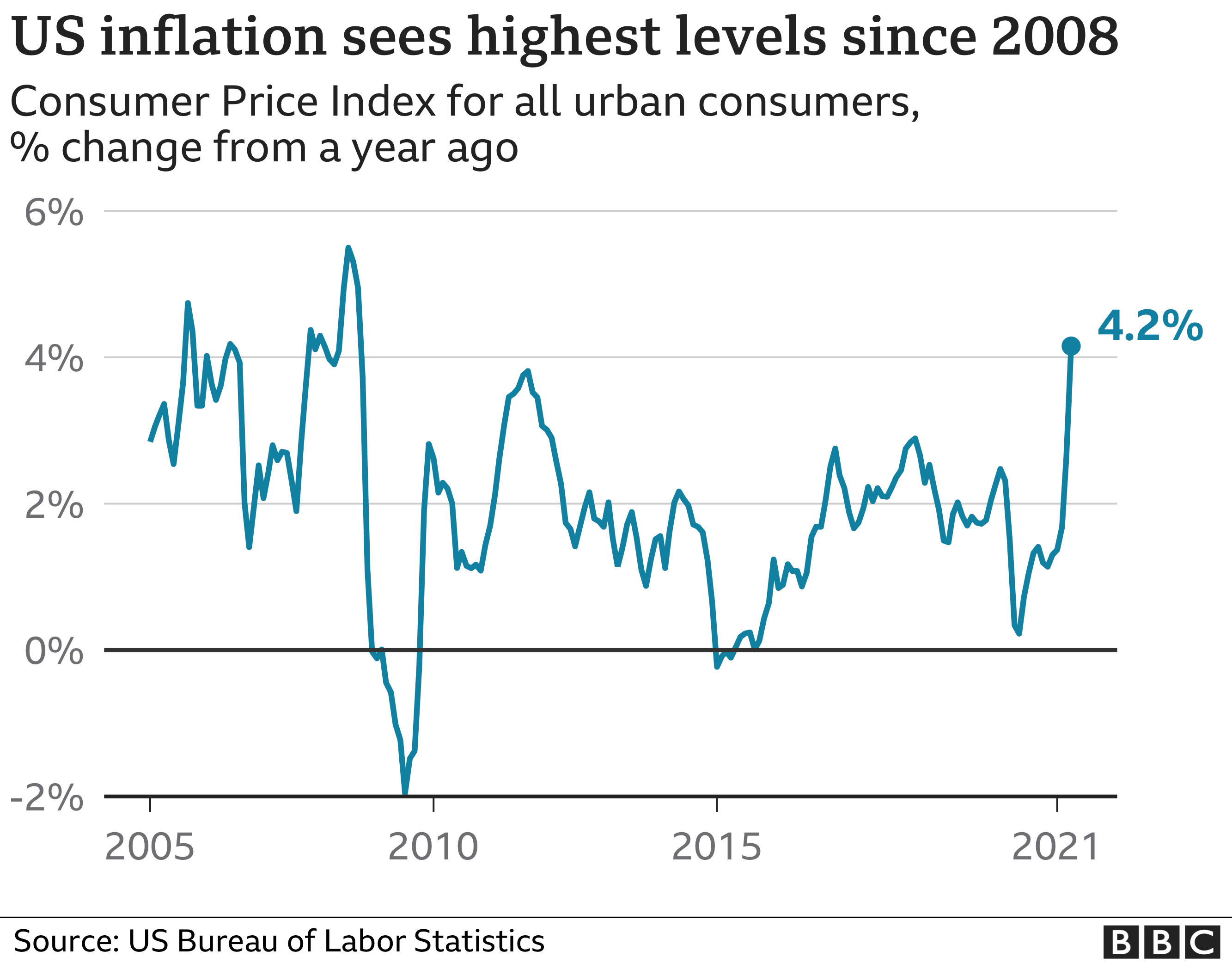

More recently, the COVID-19 pandemic has brought about unprecedented challenges, leading to a surge in inflation rates in 2021 and 2022. Supply chain disruptions, increased demand for goods, and expansive fiscal policies have all contributed to rising inflation, prompting concerns about long-term economic impacts.

What is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power over time. It is typically measured by the Consumer Price Index (CPI), which tracks the price changes of a basket of goods and services commonly consumed by households. When inflation is low, prices rise gradually, allowing consumers to plan and invest with confidence. However, when inflation is high, it can lead to uncertainty and reduced economic growth.

Inflation can be classified into three types: demand-pull inflation, cost-push inflation, and built-in inflation. Demand-pull inflation occurs when demand for goods and services exceeds supply, driving prices up. Cost-push inflation happens when production costs, such as wages and raw materials, increase, leading to higher prices. Built-in inflation arises when workers demand higher wages to keep up with rising living costs, prompting businesses to increase prices further.

What Causes Inflation?

Inflation is influenced by a multitude of factors, both domestic and international. Some of the key causes include:

Read also:Girl On Girl A Comprehensive Guide To Understanding And Celebrating Female Friendships

- Monetary Policy: Central banks, such as the Federal Reserve, control the money supply and interest rates. Expansionary monetary policy, which involves lowering interest rates and increasing money supply, can lead to inflation.

- Fiscal Policy: Government spending and tax policies can impact inflation. Increased government spending, especially during economic downturns, can stimulate demand and contribute to inflation.

- Supply Chain Disruptions: Events such as natural disasters, pandemics, or geopolitical tensions can disrupt supply chains, leading to shortages and higher prices.

- Exchange Rates: A weaker domestic currency makes imports more expensive, contributing to inflation.

- Wage-Price Spiral: Rising wages can lead to higher production costs, prompting businesses to increase prices, further fueling inflation.

How is Inflation Measured?

Inflation is primarily measured using two indexes: the Consumer Price Index (CPI) and the Producer Price Index (PPI).

- Consumer Price Index (CPI): The CPI measures the average change in prices paid by urban consumers for a fixed basket of goods and services, including food, housing, apparel, transportation, and medical care. It is the most widely used indicator of inflation.

- Producer Price Index (PPI): The PPI measures the average change in selling prices received by domestic producers for their output. It reflects price changes at the wholesale level and can be a leading indicator of consumer inflation.

Both indexes are calculated and published monthly by the Bureau of Labor Statistics (BLS) and provide valuable insights into inflationary trends.

Current Inflation Trends

As of 2023, the inflation rate in the US remains a significant economic concern. The aftermath of the COVID-19 pandemic has left lasting impacts on global supply chains, labor markets, and consumer behavior, contributing to sustained inflationary pressures. Although inflation has moderated from its peak in 2022, it remains above the Federal Reserve's target, prompting ongoing policy adjustments.

Key sectors experiencing inflationary pressures include housing, energy, and food, with prices continuing to rise due to supply constraints and increased demand. As the Federal Reserve navigates the delicate balance between controlling inflation and supporting economic growth, interest rate hikes have been implemented to curb inflationary pressures.

The long-term outlook for inflation in the US will depend on various factors, including the resolution of supply chain issues, labor market dynamics, and the effectiveness of monetary and fiscal policies in restoring economic stability.

Impacts of Inflation on the Economy

Inflation has far-reaching effects on the economy, influencing various aspects of economic activity, including:

- Purchasing Power: As inflation rises, the purchasing power of consumers decreases, leading to reduced consumption and potential economic slowdown.

- Interest Rates: Central banks may increase interest rates to combat inflation, leading to higher borrowing costs for consumers and businesses.

- Investment: Inflation can erode the real returns on investments, prompting investors to seek assets that provide inflation protection, such as real estate or commodities.

- Wages: Inflation can outpace wage growth, reducing real incomes and affecting living standards.

- Government Debt: Inflation can reduce the real value of government debt, potentially easing fiscal burdens.

How Does Inflation Affect Consumers?

Consumers are directly impacted by inflation in various ways, including:

- Rising Prices: Inflation leads to higher prices for essential goods and services, reducing disposable income and affecting living standards.

- Savings Erosion: Inflation erodes the real value of savings, making it essential for consumers to seek higher-yielding investment options.

- Debt Repayment: Inflation can benefit borrowers, as the real value of debt diminishes over time, making it easier to repay loans.

- Budgeting Challenges: Consumers may face difficulties in budgeting and financial planning, as inflation creates uncertainty about future costs.

How Does Inflation Affect Businesses?

Inflation presents both challenges and opportunities for businesses, including:

- Cost Management: Rising input costs can squeeze profit margins, prompting businesses to seek efficiency improvements or pass costs onto consumers.

- Pricing Strategies: Businesses may need to adjust pricing strategies to remain competitive while managing inflationary pressures.

- Investment Decisions: Inflation can impact capital investment decisions, as businesses weigh the cost of borrowing against potential returns.

- Labor Costs: Businesses may face pressure to increase wages in response to rising living costs, affecting overall labor expenses.

Inflation and Investment Strategies

Investors must consider inflation when formulating investment strategies to preserve and grow wealth. Some strategies to mitigate inflation risk include:

- Real Assets: Investing in real assets, such as real estate, commodities, or infrastructure, can provide a hedge against inflation.

- Inflation-Linked Bonds: Treasury Inflation-Protected Securities (TIPS) are government bonds that adjust for inflation, preserving purchasing power.

- Equities: Stocks can offer long-term growth potential, outpacing inflation if companies can pass on price increases to consumers.

- Diversification: A diversified investment portfolio can help spread risk and enhance returns in an inflationary environment.

How is Inflation Controlled?

Controlling inflation is a primary objective of central banks, which employ various tools and strategies, including:

- Monetary Policy: Central banks adjust interest rates and control money supply to influence inflation. Raising interest rates can reduce borrowing and spending, slowing inflation.

- Fiscal Policy: Governments can use taxation and spending to influence economic activity and control inflation.

- Supply-Side Measures: Policies aimed at increasing productivity and efficiency can help reduce inflationary pressures by boosting supply.

- Exchange Rate Management: A stable currency can help control import prices and mitigate inflationary pressures.

Future Predictions for Inflation Rates

Predicting future inflation rates involves analyzing current economic conditions, policy measures, and external factors. Experts anticipate that inflation will gradually decline as supply chain disruptions ease and monetary policies take effect. However, uncertainties remain, such as geopolitical tensions, labor market dynamics, and energy prices, which could influence inflationary trends.

Long-term inflation expectations will also depend on technological advancements, demographic changes, and global economic integration, which can impact productivity and cost structures. Policymakers and economists will continue to monitor these factors closely to adjust strategies and maintain economic stability.

Inflation and Government Policy

Government policies play a crucial role in managing inflation and ensuring economic stability. Key policy measures include:

- Monetary Policy: The Federal Reserve's actions, such as setting interest rates and controlling money supply, directly influence inflation.

- Fiscal Policy: Government spending and taxation decisions impact demand and supply, affecting inflationary pressures.

- Regulatory Measures: Policies aimed at enhancing competition and reducing barriers can help control inflation by increasing market efficiency.

- Trade Policies: International trade agreements and tariffs can influence import prices and inflation.

Inflation in the Global Economic Context

Inflation is not confined to national borders; it is a global phenomenon influenced by international trade, currency exchange rates, and geopolitical events. The interconnectedness of the global economy means that inflation in one country can have ripple effects, impacting trade partners and global markets.

Recent global events, such as the COVID-19 pandemic and geopolitical tensions, have highlighted the importance of international cooperation in addressing inflationary challenges. Countries must work together to stabilize supply chains, manage currency fluctuations, and implement coordinated policy measures to ensure global economic stability.

Frequently Asked Questions

What is the current inflation rate in the US?

The current inflation rate in the US varies, but as of mid-2023, it remains above the Federal Reserve's target, reflecting ongoing economic adjustments.

How does inflation affect the cost of living?

Inflation increases the cost of living by raising prices for goods and services, reducing disposable income, and affecting purchasing power.

Why is controlling inflation important?

Controlling inflation is vital to maintaining economic stability, ensuring sustainable growth, and protecting consumers' purchasing power.

Can inflation be beneficial?

Moderate inflation can signal economic growth, encourage spending and investment, and reduce the real burden of debt.

How do central banks respond to inflation?

Central banks respond to inflation by adjusting interest rates, controlling money supply, and implementing monetary policies to stabilize prices.

What are the long-term impacts of inflation?

Long-term impacts of inflation include changes in consumer behavior, investment strategies, and economic policies, influencing growth and stability.

Conclusion

Understanding and managing inflation is crucial for ensuring economic stability and growth in the US. As we have explored, the inflation rate in the US is influenced by various factors, including monetary and fiscal policies, supply chain dynamics, and global economic conditions. While inflation poses challenges, it also presents opportunities for strategic planning and investment.

By staying informed about inflationary trends and adopting appropriate measures, individuals, businesses, and policymakers can navigate the complexities of inflation and contribute to a resilient and prosperous economy. As the US continues to adapt to changing economic landscapes, addressing inflation will remain a priority for sustaining long-term economic health.