In today’s fast-paced digital economy, businesses need more than just traditional banking systems to manage their financial operations effectively. Enter modern treasury solutions — a revolutionary approach to financial management that integrates cutting-edge technology, seamless workflows, and real-time visibility into an organization’s cash flow. These solutions are reshaping the way companies handle payments, reconcile transactions, and manage their financial ecosystems, making them indispensable for businesses of all sizes.

Modern treasury solutions provide a comprehensive suite of tools that automate and streamline complex financial processes. From payment processing and tracking to reconciliation and compliance, these platforms empower finance teams to focus on strategic decision-making rather than being bogged down by manual tasks. With the increasing complexity of global transactions and the demand for faster payment cycles, adopting a modern treasury system is no longer a luxury but a necessity for organizations looking to stay ahead in the competitive marketplace.

But what makes modern treasury solutions truly transformative is their ability to foster collaboration between finance, operations, and technology teams. They act as the backbone of financial infrastructure, ensuring transparency, reducing errors, and enhancing operational efficiency. In this article, we’ll dive deep into the key components of modern treasury systems, their benefits, and how businesses can leverage them to drive growth and innovation.

Read also:The Dietary Habits Of Sea Turtles Do They Eat Jellyfish

Table of Contents

- What is Modern Treasury?

- Key Features of Modern Treasury

- How Do Modern Treasury Solutions Work?

- Why Are Modern Treasury Solutions Important?

- Benefits of Modern Treasury

- Modern Treasury vs. Traditional Treasury

- Modern Treasury Use Cases

- How to Choose the Right Modern Treasury Solution?

- Key Challenges in Adopting Modern Treasury

- Modern Treasury and Compliance

- Integration of Modern Treasury with ERPs

- Future of Modern Treasury

- FAQs about Modern Treasury

- Conclusion

What is Modern Treasury?

Modern treasury refers to the advanced systems and processes that enable organizations to manage their financial operations more efficiently. Unlike traditional treasury methods, modern treasury solutions are built on cloud-based platforms, offering real-time data accessibility, automation, and enhanced security. These systems are designed to handle everything from payment operations to transaction reconciliation and financial reporting.

Personal Details and Bio Data of Modern Treasury

| Aspect | Details |

|---|---|

| Definition | A technology-driven system for managing financial operations |

| Core Functions | Payment processing, reconciliation, compliance, and cash flow management |

| Key Technologies | Cloud computing, APIs, real-time analytics |

| Target Users | Businesses of all sizes, finance teams, and operations managers |

| Primary Benefits | Automation, transparency, efficiency, and scalability |

Key Features of Modern Treasury

Modern treasury platforms come with a plethora of features designed to simplify and enhance financial processes. Some of the standout features include:

- Payment Automation: Automates payment workflows, reducing manual intervention and errors.

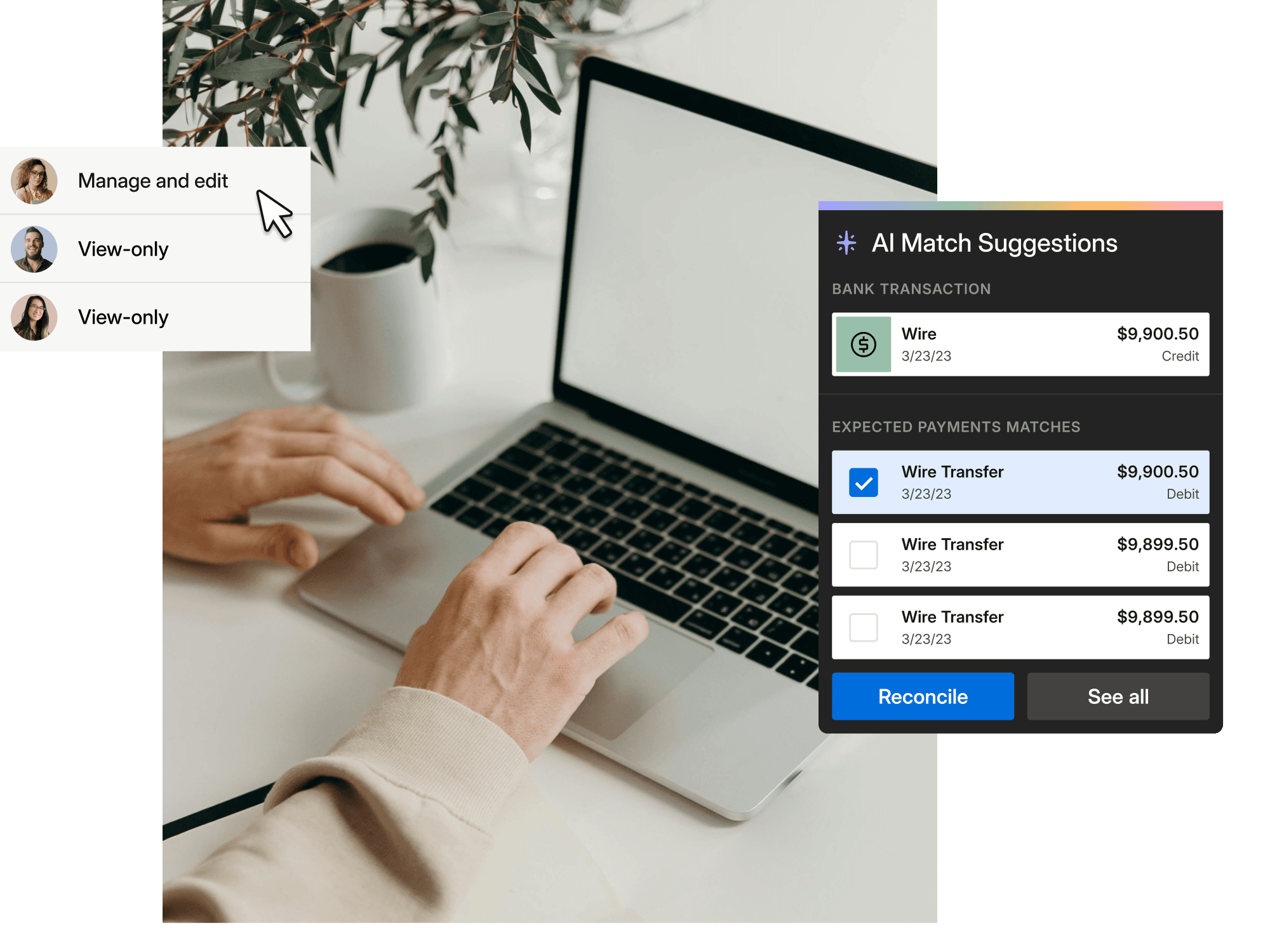

- Real-Time Reconciliation: Matches incoming and outgoing transactions instantly for accurate financial reporting.

- API Integrations: Seamlessly connects with banks, ERPs, and other financial systems.

- Data Security: Employs robust encryption and compliance standards to safeguard financial data.

- Custom Reporting: Provides detailed insights into cash flow, liquidity, and financial performance.

How Do Modern Treasury Solutions Work?

Modern treasury solutions operate by integrating with an organization’s existing financial ecosystem, including its banks, payment processors, and internal systems. The process typically involves:

- Integration: Using APIs to connect with financial institutions and internal software.

- Automation: Setting up automated workflows for payment approvals, processing, and reconciliation.

- Monitoring: Real-time tracking of cash flow and transaction statuses.

- Reporting: Generating insights and dashboards for informed decision-making.

Why Are Modern Treasury Solutions Important?

In a world where businesses are increasingly global and transactions are more frequent, modern treasury solutions offer the agility and precision required to stay competitive. They help organizations:

- Reduce operational costs through automation.

- Increase accuracy in financial reporting and compliance.

- Enhance customer and vendor relationships with faster payments.

- Mitigate risks associated with fraud and errors.

Benefits of Modern Treasury

The adoption of modern treasury solutions offers numerous advantages:

- Scalability: Easily adapts to the growing needs of an organization.

- Efficiency: Streamlines repetitive tasks, saving time and resources.

- Transparency: Provides clear visibility into financial operations.

- Compliance: Ensures adherence to regulatory requirements.

Modern Treasury vs. Traditional Treasury

Traditional treasury systems rely heavily on manual processes, spreadsheets, and siloed systems. In contrast, modern treasury solutions offer:

Read also:Enhanced Home Aesthetics Atrium Windows And Doors

| Aspect | Traditional Treasury | Modern Treasury |

|---|---|---|

| Automation | Minimal | Extensive |

| Integration | Limited | Seamless |

| Real-Time Data | No | Yes |

| Scalability | Challenging | Effortless |

Modern Treasury Use Cases

Modern treasury solutions are versatile and can address a wide range of use cases:

- Global Payments: Simplify cross-border transactions and currency conversions.

- Startup Scalability: Enable startups to scale their financial operations without adding complexity.

- Corporate Finance: Manage large volumes of transactions efficiently for enterprises.

How to Choose the Right Modern Treasury Solution?

When selecting a modern treasury solution, consider the following factors:

- Compatibility with existing systems.

- Scalability to meet future needs.

- Security features and compliance standards.

- Cost-effectiveness and ROI potential.

Key Challenges in Adopting Modern Treasury

While modern treasury solutions offer numerous benefits, organizations may face challenges such as:

- High initial implementation costs.

- Resistance to change from internal teams.

- Ensuring data security and compliance.

Modern Treasury and Compliance

Compliance is a critical aspect of financial management. Modern treasury solutions ensure adherence to regulations by:

- Automating compliance checks.

- Providing audit trails and detailed reporting.

- Ensuring data security through encryption and access controls.

Integration of Modern Treasury with ERPs

Modern treasury systems can seamlessly integrate with Enterprise Resource Planning (ERP) software, enabling:

- Streamlined financial workflows.

- Centralized data management.

- Enhanced decision-making through unified reporting.

Future of Modern Treasury

As technology evolves, modern treasury systems are expected to become even more sophisticated, incorporating:

- AI and machine learning for predictive analytics.

- Blockchain for secure and transparent transactions.

- Advanced APIs for enhanced interoperability.

FAQs about Modern Treasury

What is a modern treasury system?

A modern treasury system is a technology-driven platform designed to manage financial operations efficiently, offering features like payment automation, real-time reconciliation, and compliance management.

How does a modern treasury solution benefit businesses?

It helps businesses streamline operations, reduce costs, improve accuracy, and enhance transparency in financial processes.

What industries can benefit from modern treasury systems?

Industries such as e-commerce, manufacturing, technology, and financial services can significantly benefit from these solutions.

What challenges do companies face when implementing modern treasury solutions?

Challenges include high initial costs, integration complexities, and resistance to change from staff.

Can modern treasury solutions integrate with existing ERP systems?

Yes, most modern treasury platforms are designed to integrate seamlessly with ERP systems, enhancing overall operational efficiency.

Is data security a concern with modern treasury solutions?

Modern treasury platforms prioritize data security with encryption, access controls, and compliance with industry standards.

Conclusion

Modern treasury solutions represent a significant leap forward in financial management, offering businesses the tools they need to thrive in a dynamic and competitive environment. By automating processes, enhancing transparency, and ensuring compliance, these systems empower organizations to focus on growth and innovation. As technology continues to evolve, the future of modern treasury looks brighter than ever, promising even more advanced capabilities and benefits.