Holiday pay is a well-deserved perk for employees, and understanding when you qualify for time and a half is essential for maximizing your earnings. Many employers provide additional compensation for working on specific holidays, rewarding employees for their dedication during times when others are celebrating with family and friends. However, the specifics of holiday pay can vary widely depending on your employer, industry, and location.

Most employees want to know which holidays guarantee time and a half pay and how to ensure they receive it. From federal holidays like Christmas Day and Thanksgiving to company-specific holidays, navigating these policies can be confusing. This article breaks down everything you need to know about holiday pay, making it easy to understand your rights and entitlements. Whether you're new to the workforce or a seasoned professional, this guide will help you make the most of your holiday work schedule.

In this comprehensive article, we’ll explore the holidays that typically qualify for time and a half pay, how different industries approach holiday pay, and what you can do to ensure you're compensated fairly. We’ll also address frequently asked questions to clarify common misconceptions about holiday pay policies. Let’s dive in!

Read also:Innovative Strategies For Progressive Sign In

Table of Contents

- What Is Holiday Pay?

- Why Do Some Holidays Offer Time and a Half?

- Which Holidays Qualify for Time and a Half?

- Does Everyone Get Holiday Pay?

- How Do State Laws Affect Holiday Pay?

- What Are Common Holidays for Time and a Half?

- Do Private Companies Follow the Same Rules?

- How Do Unions Impact Holiday Pay?

- Tips for Discussing Holiday Pay with Your Employer

- What Industries Commonly Offer Holiday Pay?

- Can You Refuse to Work on Holidays?

- How to Calculate Time and a Half?

- What If You Don’t Receive Holiday Pay?

- Frequently Asked Questions

- Conclusion

What Is Holiday Pay?

Holiday pay is additional compensation provided to employees who work on designated holidays. This can include extra wages, paid time off, or both. In many cases, employees receive time and a half pay, meaning they are compensated at 1.5 times their regular hourly rate for hours worked on specific holidays. Employers may implement holiday pay policies to incentivize employees to work during times when staffing may be limited.

Holiday pay policies vary significantly depending on factors like company size, industry, and location. While some employers offer holiday pay for all employees, others may only provide it to full-time workers or those with seniority.

It’s important to note that federal law does not mandate holiday pay. However, many employers choose to offer it as a way to attract and retain talent. Understanding your employer’s holiday pay policy is crucial to ensure you’re receiving the compensation you’re entitled to.

Why Do Some Holidays Offer Time and a Half?

Time and a half pay is often offered on holidays as a way to recognize the sacrifices employees make by working during times traditionally reserved for rest, celebration, and family gatherings. This additional compensation serves as both an incentive and a reward for working during these special days.

Employers may also offer time and a half pay to maintain adequate staffing levels during holidays. Since many employees prefer not to work on these days, higher wages can encourage more people to take on holiday shifts. This is particularly important in industries like healthcare, retail, and hospitality, where services are often in high demand during holidays.

Which Holidays Qualify for Time and a Half?

Not all holidays qualify for time and a half pay. The specific holidays that offer this benefit depend on your employer, industry, and location. However, some common holidays that often qualify for time and a half include:

Read also:Csuf Basketball A Thrilling Dive Into The Titans Court

- New Year’s Day

- Memorial Day

- Independence Day (July 4th)

- Labor Day

- Thanksgiving Day

- Christmas Day

In addition to these federal holidays, some employers may offer time and a half pay for other holidays, such as Easter Sunday, Veterans Day, or company-specific holidays. It's best to review your employee handbook or consult your HR department for a definitive list of holidays that qualify for time and a half pay at your workplace.

Does Everyone Get Holiday Pay?

Are part-time employees eligible for holiday pay?

Holiday pay eligibility often depends on your employment status. While full-time employees are more likely to receive holiday pay, part-time and temporary workers may not be eligible. Some employers do extend holiday pay to part-time workers, but this is not guaranteed.

What about independent contractors?

Independent contractors and freelancers are typically not eligible for holiday pay because they are not considered employees. Instead, they negotiate their own rates and payment terms, which may or may not include additional compensation for holiday work.

How Do State Laws Affect Holiday Pay?

State laws play a significant role in determining holiday pay policies. While federal law does not mandate holiday pay, some states have implemented their own regulations. For example, Massachusetts has a "Blue Laws" policy that requires retailers to pay employees time and a half on Sundays and certain holidays.

It’s essential to familiarize yourself with your state’s labor laws to understand your rights regarding holiday pay. In some cases, state laws may only apply to specific industries or types of businesses.

What Are Common Holidays for Time and a Half?

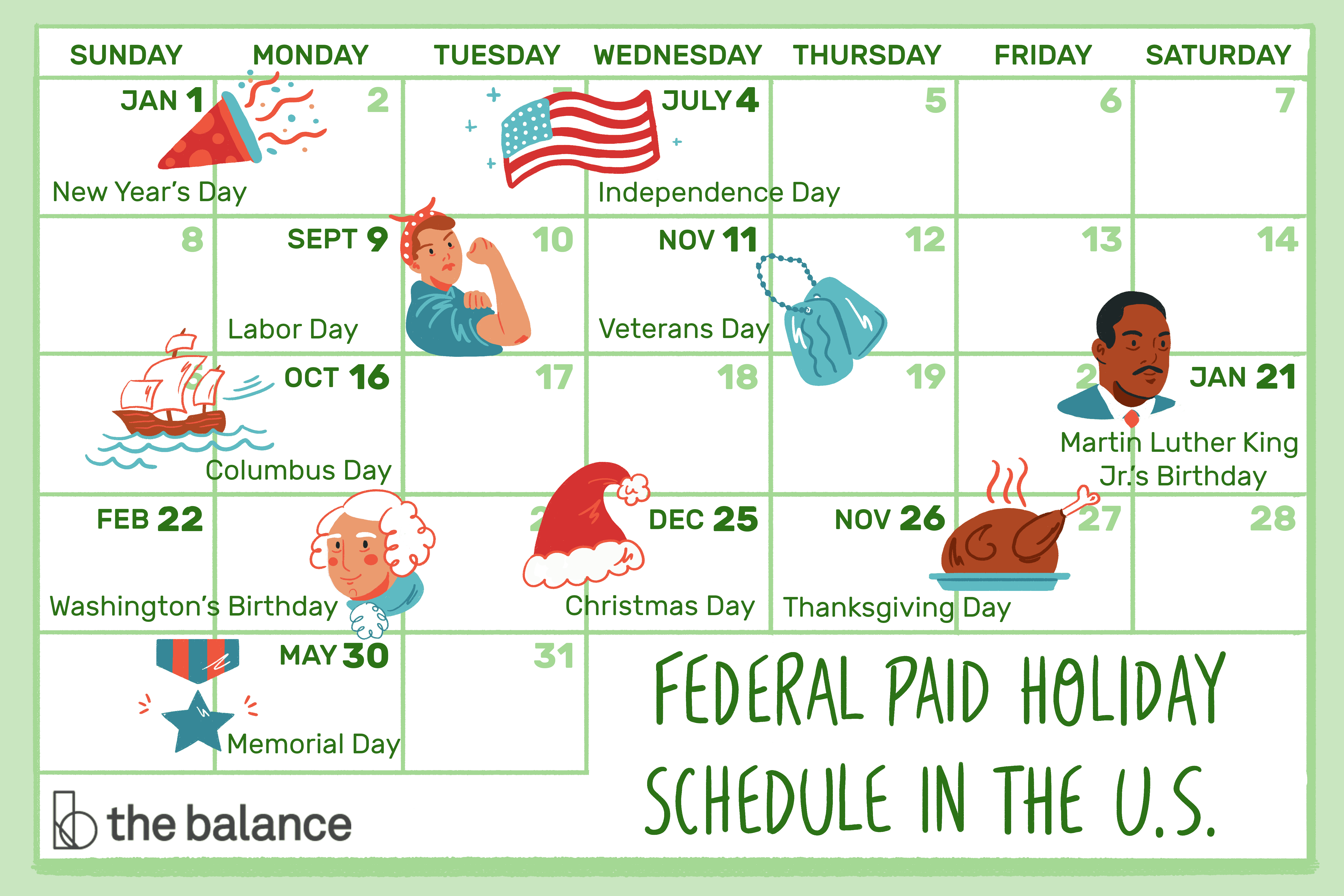

The most common holidays that offer time and a half pay are federal holidays recognized by the U.S. government. These include:

- New Year’s Day

- Martin Luther King Jr. Day

- Presidents’ Day

- Memorial Day

- Independence Day

- Labor Day

- Veterans Day

- Thanksgiving Day

- Christmas Day

Some employers may also include additional holidays, such as religious observances or company-specific events, in their holiday pay policies.

Do Private Companies Follow the Same Rules?

Private companies have more flexibility in setting their holiday pay policies. Unlike government employers, private businesses are not required to observe federal holidays or offer time and a half pay. Instead, these decisions are typically left to the discretion of the employer.

Many private companies choose to offer holiday pay as a competitive benefit to attract and retain employees. However, it’s always a good idea to review your employment contract or speak with your HR department to understand your company’s specific holiday pay policies.

How Do Unions Impact Holiday Pay?

Unions can significantly influence holiday pay policies through collective bargaining agreements. These agreements often include provisions for holiday pay, specifying which holidays qualify for time and a half and the conditions under which employees are eligible.

If you’re part of a union, you can consult your union representative or review your collective bargaining agreement to understand your holiday pay entitlements.

Tips for Discussing Holiday Pay with Your Employer

If you’re unsure about your holiday pay eligibility or believe you’re not receiving fair compensation, it’s important to address the issue with your employer. Here are some tips for discussing holiday pay:

- Review your employee handbook or employment contract to understand your company’s policy.

- Schedule a meeting with your HR department or supervisor to discuss your concerns.

- Be polite but assertive when explaining why you believe you’re entitled to holiday pay.

- Provide documentation, such as pay stubs or policy excerpts, to support your case.

What Industries Commonly Offer Holiday Pay?

Some industries are more likely to offer holiday pay than others. Common industries that provide time and a half pay include:

- Retail

- Hospitality

- Healthcare

- Transportation

- Public safety (e.g., police and fire departments)

These industries often require employees to work during holidays to meet customer demand or provide essential services.

Can You Refuse to Work on Holidays?

In most cases, employers can require employees to work on holidays, especially if your employment contract specifies that holiday work is mandatory. However, some exceptions may apply. For example, if you have religious obligations that conflict with your work schedule, you may be entitled to accommodations under federal law.

How to Calculate Time and a Half?

Calculating time and a half pay is relatively straightforward. Simply multiply your regular hourly rate by 1.5. For example, if your hourly rate is $20, your time and a half rate would be $30 per hour.

What If You Don’t Receive Holiday Pay?

If you believe you’re entitled to holiday pay but are not receiving it, take the following steps:

- Review your employment contract and company policies.

- Speak with your HR department to clarify any misunderstandings.

- Consult your state’s labor laws to understand your rights.

- Consider seeking legal advice if the issue remains unresolved.

Frequently Asked Questions

Do all employers have to offer holiday pay?

No, federal law does not require employers to offer holiday pay. It’s typically up to the employer to decide whether to provide this benefit.

What is double-time pay?

Double-time pay is compensation at twice your regular hourly rate, often offered for working on certain holidays or overtime hours.

Can holiday pay be combined with overtime pay?

Yes, in some cases, you may be eligible for both holiday pay and overtime pay. This means you could earn time and a half for holiday work and additional pay for exceeding your regular work hours.

Are salaried employees eligible for holiday pay?

Salaried employees typically do not receive additional pay for working on holidays, as their compensation is not based on hourly rates. However, some employers may offer extra perks, such as additional paid time off.

Does holiday pay apply to remote workers?

Yes, remote workers can be eligible for holiday pay if their employer’s policy includes it. The location of the work does not usually impact holiday pay eligibility.

What should I do if my employer refuses to pay holiday wages?

If your employer refuses to pay holiday wages you believe you’re entitled to, document the issue and consult your state’s labor department or seek legal advice.

Conclusion

Understanding what holidays do you get paid time and a half is essential for maximizing your earnings and ensuring you’re fairly compensated for your work. While holiday pay policies can be complex, knowing your rights and communicating with your employer can help clarify any uncertainties. By staying informed and proactive, you can make the most of your holiday work schedule and enjoy the rewards of your hard work.