The Robinhood app has revolutionized the way individuals approach investing, making it more accessible and user-friendly for everyone. As a pioneer in commission-free trading, Robinhood has attracted millions of users who are eager to manage their own financial portfolios. This app has significantly lowered the barriers to entry for people who want to invest in stocks, ETFs, options, and cryptocurrencies. The Robinhood app's intuitive design and innovative features have made it a favorite among novice and seasoned investors alike.

Robinhood's mission is to democratize finance for all, and it has certainly made strides in achieving this goal. By eliminating traditional brokerage fees, the Robinhood app empowers users to take control of their investments without the pressure of additional costs. With its sleek interface and educational resources, the app provides an opportunity for users to learn and grow as investors at their own pace. Users can easily track market trends, make informed decisions, and execute trades all from the convenience of their smartphones.

As the Robinhood app continues to grow in popularity, it's essential for users to fully understand its features and capabilities. This comprehensive guide will walk you through everything you need to know about using the Robinhood app effectively. From setting up your account and navigating the interface to exploring advanced trading options and managing risks, this article will equip you with the knowledge and skills necessary to become a confident Robinhood investor. Whether you're just starting out or looking to enhance your investment strategy, this guide is designed to help you maximize your experience with the Robinhood app.

Read also:Leit Motif The Heartbeat Of Artistic Expression

Table of Contents

- What is the Robinhood App?

- How Does the Robinhood App Work?

- Setting Up Your Robinhood Account

- Navigating the Robinhood Interface

- Key Features of the Robinhood App

- Understanding Robinhood's Commission-Free Trading

- What Are the Risks of Using Robinhood?

- Exploring Investment Options on Robinhood

- Advanced Trading Strategies with Robinhood

- How to Use Robinhood's Research Tools?

- Can You Trust the Robinhood App?

- How to Manage Your Portfolio on Robinhood?

- Robinhood App vs. Other Investment Platforms

- Frequently Asked Questions

- Conclusion

What is the Robinhood App?

The Robinhood app is a financial services platform that offers commission-free trading of stocks, ETFs, options, and cryptocurrencies. Founded in 2013 by Vladimir Tenev and Baiju Bhatt, the app was designed to make investing accessible to everyone, regardless of their financial background. With its easy-to-use interface and mobile-first approach, Robinhood has gained widespread popularity among millennials and Gen Z users.

Robinhood's innovative business model disrupts traditional brokerage firms by eliminating fees that often deter new investors. The app's revenue comes from alternative sources such as payment for order flow, Robinhood Gold subscriptions, and interest on cash balances. As a result, users can trade without worrying about commission fees, allowing them to focus on growing their portfolios.

In addition to its core trading services, the Robinhood app provides educational resources and insights to help users make informed investment decisions. The app's news feed, market data, and research tools empower investors with the information they need to navigate the complex world of finance.

How Does the Robinhood App Work?

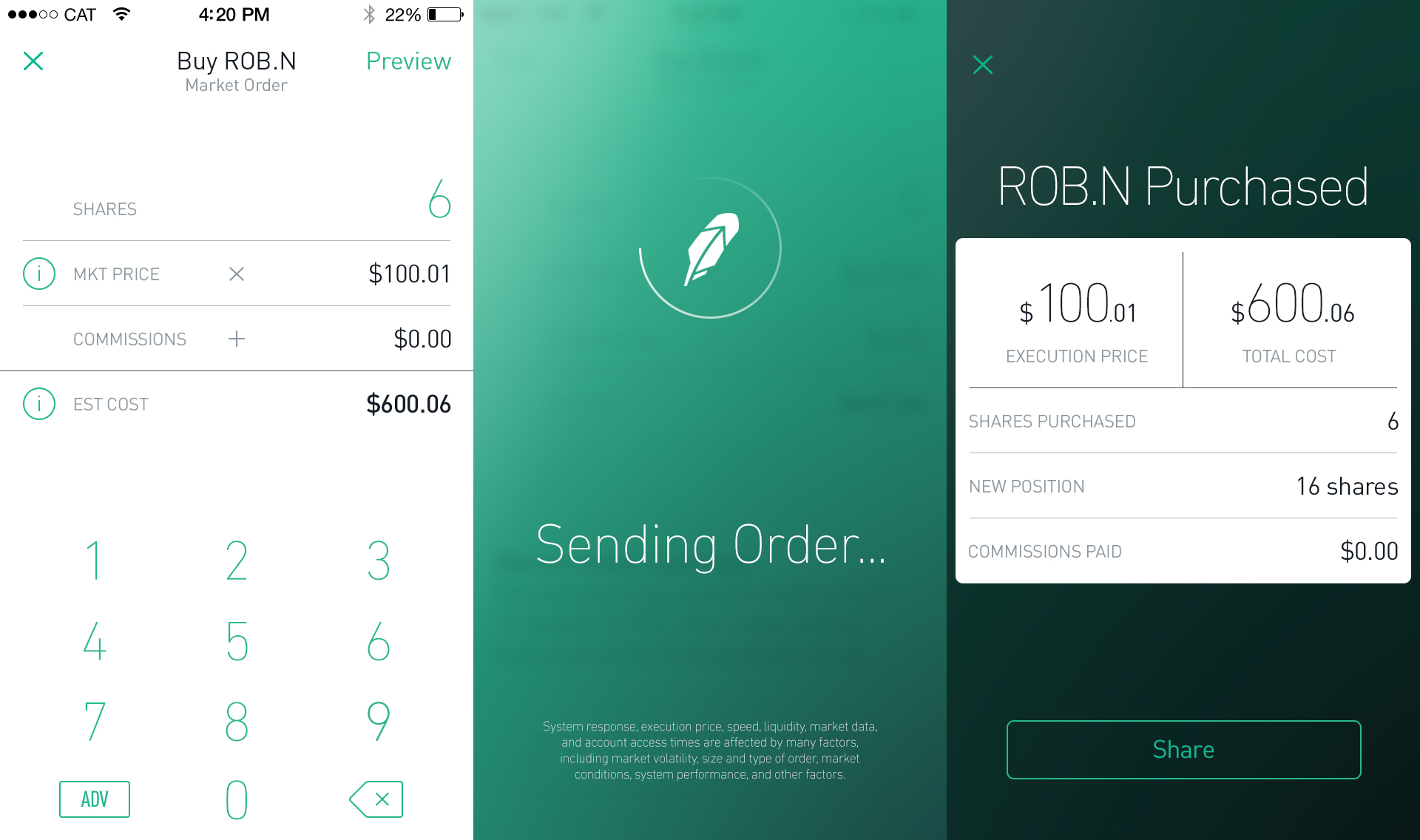

The Robinhood app operates as a brokerage firm, facilitating the buying and selling of financial assets on behalf of its users. To get started, users must create an account and link it to their bank account. Once the account is verified, users can deposit funds and begin trading.

Robinhood's user-friendly interface allows users to search for stocks, ETFs, options, and cryptocurrencies easily. The app provides real-time market data and charts to help users analyze their potential investments. When a user decides to buy or sell an asset, Robinhood executes the trade on their behalf.

One of the standout features of the Robinhood app is its commission-free trading model. Unlike traditional brokerages that charge fees for each trade, Robinhood allows users to buy and sell assets without incurring additional costs. This model makes investing more accessible, especially for those who are new to the financial markets.

Read also:Secrets Of Cena Tampa A Comprehensive Guide

Setting Up Your Robinhood Account

Creating a Robinhood account is a straightforward process that can be completed in a few simple steps. To get started, users must download the app from the App Store or Google Play and follow the on-screen instructions.

Here are the steps to set up your Robinhood account:

- Download the Robinhood app and open it on your device.

- Tap "Sign Up" and enter your email address, password, and other required information.

- Verify your identity by providing your Social Security number, date of birth, and address.

- Link your bank account to your Robinhood account to fund your trading activities.

- Once your account is verified, you can start exploring the app and making your first trades.

After setting up your account, it's essential to familiarize yourself with the app's features and tools. Robinhood offers a range of educational resources and tutorials to help users get started on their investment journey.

Navigating the Robinhood Interface

The Robinhood app's interface is designed to be intuitive and user-friendly, making it easy for users to navigate and access the information they need. The home screen displays an overview of the user's portfolio, including account balance, recent transactions, and a list of favorite stocks.

Users can access various sections of the app through the navigation bar at the bottom of the screen. These sections include:

- Portfolio: View a summary of your investments, including total value, returns, and recent activity.

- Search: Find stocks, ETFs, options, and cryptocurrencies using the search bar.

- Watchlist: Keep track of your favorite stocks and monitor their performance.

- History: Review your past transactions and trading history.

- Account: Manage your account settings, including linked bank accounts, notifications, and security features.

By understanding how to navigate the Robinhood interface, users can make the most of the app's features and tools, enhancing their investment experience.

Key Features of the Robinhood App

The Robinhood app offers a variety of features that cater to the needs of both novice and experienced investors. Some of the key features include:

- Commission-Free Trading: Buy and sell stocks, ETFs, options, and cryptocurrencies without incurring fees.

- Fractional Shares: Invest in stocks with as little as $1, allowing users to buy a portion of a stock rather than a full share.

- Robinhood Gold: Access premium features such as margin trading, advanced research tools, and larger instant deposits for a monthly fee.

- Recurring Investments: Automate your investments by setting up recurring purchases of stocks or ETFs.

- Cash Management: Earn interest on uninvested cash and access a debit card for everyday spending.

These features make the Robinhood app a versatile tool for investors looking to manage their portfolios and take advantage of market opportunities.

Understanding Robinhood's Commission-Free Trading

Robinhood's commission-free trading model is one of its most significant selling points. By eliminating traditional brokerage fees, the app allows users to invest without worrying about the cost of each trade.

While commission-free trading is an attractive feature, it's essential to understand how Robinhood makes money. The company generates revenue through several channels, including:

- Payment for Order Flow: Robinhood receives compensation from market makers for directing trades to them.

- Robinhood Gold: Subscription fees for premium services, such as margin trading and advanced research tools.

- Interest on Cash Balances: Earning interest on uninvested cash held in user accounts.

- Interchange Fees: Fees collected from merchants when users make purchases with their Robinhood debit card.

By understanding how Robinhood generates revenue, users can make informed decisions about using the app and take advantage of its commission-free trading model.

What Are the Risks of Using Robinhood?

While the Robinhood app offers numerous benefits, it's essential to be aware of the potential risks associated with using the platform. Some of these risks include:

- Volatility: The stock market is inherently volatile, and investments can fluctuate in value. Users should be prepared for potential losses.

- Limited Research Tools: While Robinhood offers some research tools, they may not be as comprehensive as those provided by traditional brokerages.

- Order Execution: Robinhood's reliance on payment for order flow may impact the quality of order execution, potentially leading to less favorable prices.

- Technical Issues: The app has experienced outages and technical issues in the past, which can disrupt trading activities.

By understanding these risks, users can take steps to mitigate potential challenges and make informed decisions when using the Robinhood app.

Exploring Investment Options on Robinhood

The Robinhood app offers a wide range of investment options to suit various financial goals and risk tolerance levels. Users can choose from the following asset classes:

- Stocks: Invest in individual companies and take advantage of potential growth opportunities.

- ETFs: Diversify your portfolio by investing in exchange-traded funds that track various market indices.

- Options: Trade options contracts to speculate on the future price movements of underlying assets.

- Cryptocurrencies: Buy and sell digital currencies such as Bitcoin, Ethereum, and Dogecoin.

By exploring these investment options, users can build a diversified portfolio that aligns with their financial objectives and risk tolerance.

Advanced Trading Strategies with Robinhood

For experienced investors, the Robinhood app offers several advanced trading strategies to enhance portfolio performance. Some of these strategies include:

- Margin Trading: Borrow funds to increase trading capacity and potentially amplify returns.

- Options Trading: Utilize options contracts to hedge risk, generate income, or speculate on market movements.

- Technical Analysis: Use charts and indicators to identify trends and make informed trading decisions.

- Dividend Investing: Focus on stocks with a history of paying dividends to generate passive income.

By employing these advanced trading strategies, users can take advantage of market opportunities and optimize their investment performance on the Robinhood app.

How to Use Robinhood's Research Tools?

Robinhood offers several research tools to help users make informed investment decisions. These tools include:

- Market Data: Access real-time quotes, charts, and key statistics for stocks and other assets.

- News Feed: Stay updated on market trends and company news with curated articles and insights.

- Analyst Ratings: View analyst recommendations and price targets for stocks.

- Financial Statements: Review financial reports and key metrics for publicly traded companies.

By leveraging these research tools, users can gain valuable insights into their investments and make informed decisions on the Robinhood app.

Can You Trust the Robinhood App?

The Robinhood app is a legitimate and regulated financial services platform that adheres to industry standards and regulations. However, users should be aware of the app's history of controversies and challenges, including:

- Customer Service: Robinhood has faced criticism for its customer support, with some users reporting delays in resolving issues.

- Security Breaches: Like any online platform, Robinhood is susceptible to security threats and has experienced data breaches in the past.

- Regulatory Scrutiny: The app has faced regulatory scrutiny for its business practices and compliance with industry regulations.

Despite these challenges, Robinhood continues to be a popular choice for investors, thanks to its innovative features and commission-free trading model. By staying informed and vigilant, users can safely navigate the app and take advantage of its benefits.

How to Manage Your Portfolio on Robinhood?

Managing your portfolio on the Robinhood app involves regular monitoring and adjustments to align with your financial goals. Here are some tips for effective portfolio management:

- Set Clear Goals: Define your investment objectives and risk tolerance to guide your decision-making.

- Diversify: Spread your investments across different asset classes and sectors to reduce risk.

- Monitor Performance: Regularly review your portfolio's performance and make adjustments as needed.

- Rebalance: Periodically rebalance your portfolio to maintain your desired asset allocation.

By following these tips, users can effectively manage their portfolios and achieve their financial objectives on the Robinhood app.

Robinhood App vs. Other Investment Platforms

The Robinhood app is just one of many investment platforms available to investors today. When comparing Robinhood to other platforms, consider the following factors:

- Fees: Robinhood's commission-free model is a significant advantage, but other platforms may offer additional features for a fee.

- Research Tools: Some platforms provide more comprehensive research tools and educational resources than Robinhood.

- Investment Options: While Robinhood offers a wide range of assets, other platforms may provide access to additional investment products such as mutual funds or bonds.

- User Experience: Consider the platform's interface, ease of use, and customer support when making your decision.

By weighing these factors, users can choose the investment platform that best suits their needs and preferences.

Frequently Asked Questions

Is the Robinhood app free to use?

Yes, the Robinhood app is free to use, and users can trade stocks, ETFs, options, and cryptocurrencies without paying commission fees. However, certain premium features, such as Robinhood Gold, may require a subscription fee.

How safe is the Robinhood app?

The Robinhood app is generally safe to use, as it employs industry-standard security measures to protect user data. However, like any online platform, it is susceptible to security threats, and users should take precautions to safeguard their accounts.

Can I trade fractional shares on Robinhood?

Yes, Robinhood allows users to trade fractional shares, enabling them to invest in stocks with as little as $1. This feature makes it easier for users to diversify their portfolios and invest in high-priced stocks.

What types of accounts does Robinhood offer?

Robinhood offers individual taxable brokerage accounts. It does not currently offer retirement accounts such as IRAs or 401(k)s.

How does Robinhood make money?

Robinhood generates revenue through various channels, including payment for order flow, Robinhood Gold subscriptions, interest on cash balances, and interchange fees from debit card transactions.

Can I use Robinhood outside the United States?

Currently, the Robinhood app is only available to users in the United States. The company has expressed interest in expanding internationally, but there is no specific timeline for this expansion.

Conclusion

The Robinhood app has transformed the investment landscape by making it more accessible and affordable for individuals to participate in the financial markets. With its commission-free trading model and user-friendly interface, Robinhood has empowered millions of users to take control of their investments and work towards their financial goals.

While the app offers numerous benefits, it's essential for users to understand the potential risks and challenges associated with using the platform. By staying informed and leveraging the app's features and tools, investors can maximize their experience and make informed decisions in the ever-changing world of finance.

Whether you're a novice investor just starting or an experienced trader looking to enhance your strategy, the Robinhood app provides a valuable platform to help you achieve your investment objectives.