In today's digital age, the threat of fraud looms larger than ever, especially in the banking sector. Among the myriad of fraud tactics, "chase fraud text" has emerged as a significant concern. As more individuals rely on mobile banking and online transactions, understanding and identifying fraudulent messages is crucial. These deceptive texts often mimic legitimate communications from Chase Bank, aiming to trick recipients into divulging personal information.

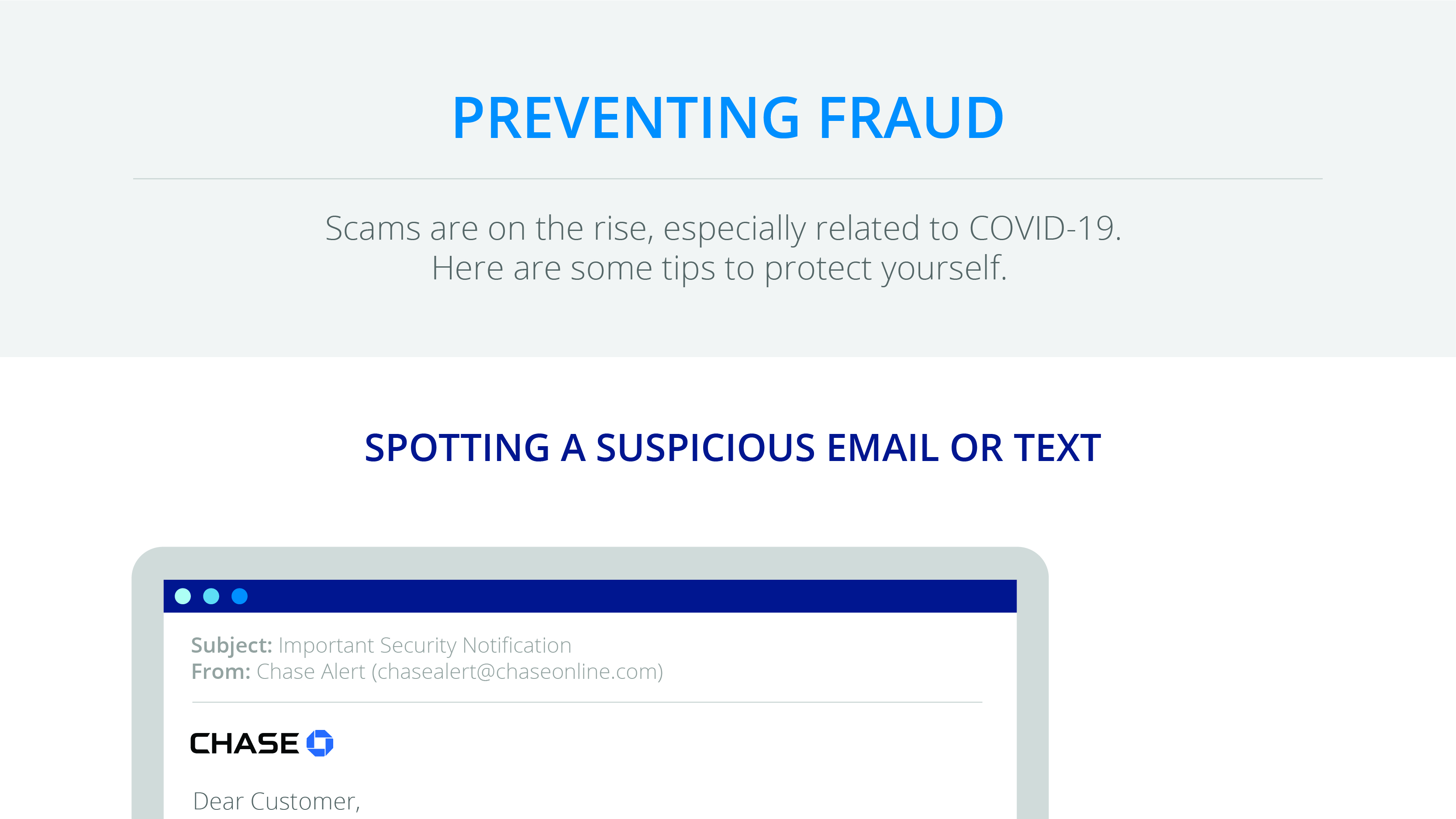

Chase fraud text messages are cunningly crafted by cybercriminals to appear genuine, often including official logos and formats to deceive even the most cautious individuals. The primary objective of these messages is to instill a sense of urgency, prompting users to click on malicious links or provide sensitive data such as login credentials and account numbers. Falling victim to such scams can lead to severe financial loss and identity theft.

To safeguard oneself against chase fraud text and other similar scams, it is essential to be well-informed. This comprehensive guide will delve into the intricacies of chase fraud text, offering insights into its workings, prevention strategies, and steps to take if you suspect you've been targeted. By enhancing awareness and understanding the tactics employed by fraudsters, individuals can better protect themselves and their financial assets.

Read also:Paper Culture A Timeless Tradition In Modern Society

Table of Contents

- What is Chase Fraud Text?

- How Does Chase Fraud Text Work?

- Recognizing Chase Fraud Text

- Common Signs of Fraudulent Texts

- Impact of Chase Fraud Text

- How to Protect Yourself?

- Steps to Take if Targeted by Fraud

- Chase Bank's Role in Preventing Fraud

- Tools and Resources for Fraud Prevention

- Legal Implications of Fraud

- How to Report Chase Fraud Text?

- Chase Fraud Text vs. Other Scams

- Educating the Public on Fraud Prevention

- The Future of Fraud Prevention

- FAQs

- Conclusion

What is Chase Fraud Text?

Chase fraud text refers to deceptive messages that are designed to look like they are from Chase Bank, but are actually sent by fraudsters. These messages often contain links or requests for personal information, with the intent of stealing sensitive data or money from unsuspecting individuals.

How Does Chase Fraud Text Work?

Fraudsters employ various techniques to make their messages appear legitimate. They often include Chase Bank's branding, use professional language, and create a sense of urgency to prompt quick action. By clicking on links or responding to these texts, victims may inadvertently provide access to their personal information.

Recognizing Chase Fraud Text

Being able to identify a chase fraud text is crucial in preventing scams. Often, these texts will have telltale signs such as grammatical errors, unusual sender numbers, or unexpected requests for personal information. Trustworthy organizations typically avoid asking for sensitive data via text.

Common Signs of Fraudulent Texts

- Unfamiliar sender number or email address

- Urgent language urging immediate action

- Requests for personal or financial information

- Links that redirect to suspicious websites

- Offers that seem too good to be true

Impact of Chase Fraud Text

The consequences of falling prey to a chase fraud text can be severe, including financial loss, identity theft, and damage to one's credit score. Victims may also experience emotional distress and a loss of trust in digital communications.

How to Protect Yourself?

Prevention is the key to safeguarding against chase fraud text scams. Here are some strategies to protect yourself:

- Never share personal information via text.

- Verify the sender's identity before responding.

- Use two-factor authentication for added security.

- Regularly update passwords and security settings.

- Be cautious of unsolicited messages or requests.

Steps to Take if Targeted by Fraud

If you suspect you've been targeted by a chase fraud text, take immediate action:

Read also:Sean Hannity Influential Media Personality And Political Commentator

- Do not respond to the message or click any links.

- Report the message to Chase Bank and your mobile carrier.

- Monitor your accounts for suspicious activity.

- Consider placing a fraud alert on your credit report.

- Consult with a financial advisor for further guidance.

Chase Bank's Role in Preventing Fraud

Chase Bank actively works to prevent fraud by implementing advanced security measures, educating customers on potential threats, and offering tools for monitoring account activity. They also collaborate with law enforcement to identify and prosecute fraudsters.

Tools and Resources for Fraud Prevention

There are numerous resources available to help individuals protect themselves from fraud. These include:

- Fraud monitoring services offered by banks

- Online guides and tutorials on recognizing scams

- Government resources like the Federal Trade Commission (FTC)

- Community workshops and seminars on digital safety

Legal Implications of Fraud

Fraud is a serious crime with significant legal consequences. Perpetrators may face hefty fines, imprisonment, and a permanent criminal record. Victims of fraud also have legal recourse and can seek restitution through civil or criminal proceedings.

How to Report Chase Fraud Text?

Reporting a chase fraud text is crucial for protecting oneself and others. Here's how to report:

- Contact Chase Bank directly through their customer service.

- Forward the message to your mobile carrier for investigation.

- Report the incident to local law enforcement if necessary.

- Inform the Federal Trade Commission (FTC) for further action.

Chase Fraud Text vs. Other Scams

While chase fraud text is a prevalent form of scam, there are many other types of fraud to be aware of, including phishing emails, vishing (voice phishing), and smishing (SMS phishing). Each type of scam has unique characteristics but shares the common goal of extracting personal information.

Educating the Public on Fraud Prevention

Public education plays a vital role in combating fraud. By raising awareness through campaigns, workshops, and educational materials, individuals can be better prepared to recognize and avoid scams. Collaboration between financial institutions, government agencies, and community groups is essential in this effort.

The Future of Fraud Prevention

As technology evolves, so too do the methods used by fraudsters. The future of fraud prevention lies in advanced technologies such as artificial intelligence, machine learning, and blockchain. These tools will enhance security measures and help to identify and neutralize threats in real time.

FAQs

- What should I do if I receive a suspicious text claiming to be from Chase Bank?

- Do not click any links or provide personal information. Report the text to Chase and your mobile carrier.

- How can I verify the authenticity of a message from Chase Bank?

- Contact Chase directly using a verified phone number or email address from their official website.

- Are there any tools to help me identify fraudulent texts?

- Yes, many banks offer fraud detection services, and there are also apps that can help identify potential scams.

- What legal actions can be taken against fraudsters?

- Fraudsters can be prosecuted criminally and may face fines, imprisonment, and restitution orders.

- Can I recover money lost to a fraud text scam?

- It depends on the circumstances, but contacting your bank immediately can improve the chances of recovery.

- What steps can I take to prevent falling victim to chase fraud text?

- Stay informed, verify all messages, and use strong security measures like two-factor authentication.

Conclusion

Chase fraud text is a sophisticated scam that requires vigilance and awareness from all potential targets. By understanding the tactics used by fraudsters and implementing robust security measures, individuals can protect themselves from these threats. Through collective efforts in education and innovation, the fight against fraud can be strengthened, ensuring a safer digital environment for everyone.