The US Debt Clock serves as a real-time representation of the United States' national debt, providing critical insights into the country's economic health. This digital clock is a constant reminder of the growing debt burden that the US government faces, which in turn affects both domestic and global financial markets. As the numbers tick upward, policymakers, economists, and citizens alike are reminded of the pressing need to address fiscal sustainability.

Understanding the US Debt Clock is crucial for anyone interested in the economic landscape of the United States. It not only displays the current national debt but also breaks down other important financial indicators such as the debt per citizen, debt per taxpayer, and interest on the national debt. By tracking these figures, one can gain a better understanding of the economic challenges facing the nation and the potential implications for future generations.

In this article, we will delve into the significance of the US Debt Clock, exploring its history, functionality, and impact on the economy and financial markets. We'll also examine the factors contributing to the national debt and the potential consequences of high debt levels. By the end of this comprehensive guide, you'll have a clearer understanding of the US Debt Clock's role in shaping the financial future of the United States.

Read also:Gacha Cute The Ultimate Guide To A Popular Phenomenon

Table of Contents

- History of the US Debt Clock

- How Does the US Debt Clock Work?

- Importance of the US Debt Clock

- What Factors Contribute to the National Debt?

- Impact on Domestic Markets

- Impact on Global Markets

- How Does the US Debt Clock Affect Investors?

- The Role of Government Policy

- Potential Consequences of High Debt Levels

- How Can the National Debt Be Managed?

- Public Awareness and Education

- Future Implications for the US Economy

- Frequently Asked Questions

- Conclusion

History of the US Debt Clock

The US Debt Clock was first introduced in 1989, an idea brought to life by real estate magnate Seymour Durst. Durst aimed to raise public awareness about the burgeoning national debt, seeing it as a crucial issue that required urgent attention. The original clock was installed in New York City's Times Square and quickly became a symbol of financial accountability.

Over the years, the US Debt Clock has undergone several updates and relocations. In 2004, it was moved to a new location near Bryant Park, and it was upgraded to accommodate the rapidly growing national debt, including the ability to display trillions of dollars. The digital clock has consistently served as a visual representation of the nation's fiscal challenges, prompting discussions on government spending and economic policies.

The clock's presence has sparked debates among policymakers, economists, and the general public. It has served as a catalyst for discussions on fiscal responsibility and the potential consequences of unchecked government spending. As a result, the US Debt Clock has become an enduring symbol of the nation's financial state, constantly reminding citizens and leaders of the importance of managing the national debt.

How Does the US Debt Clock Work?

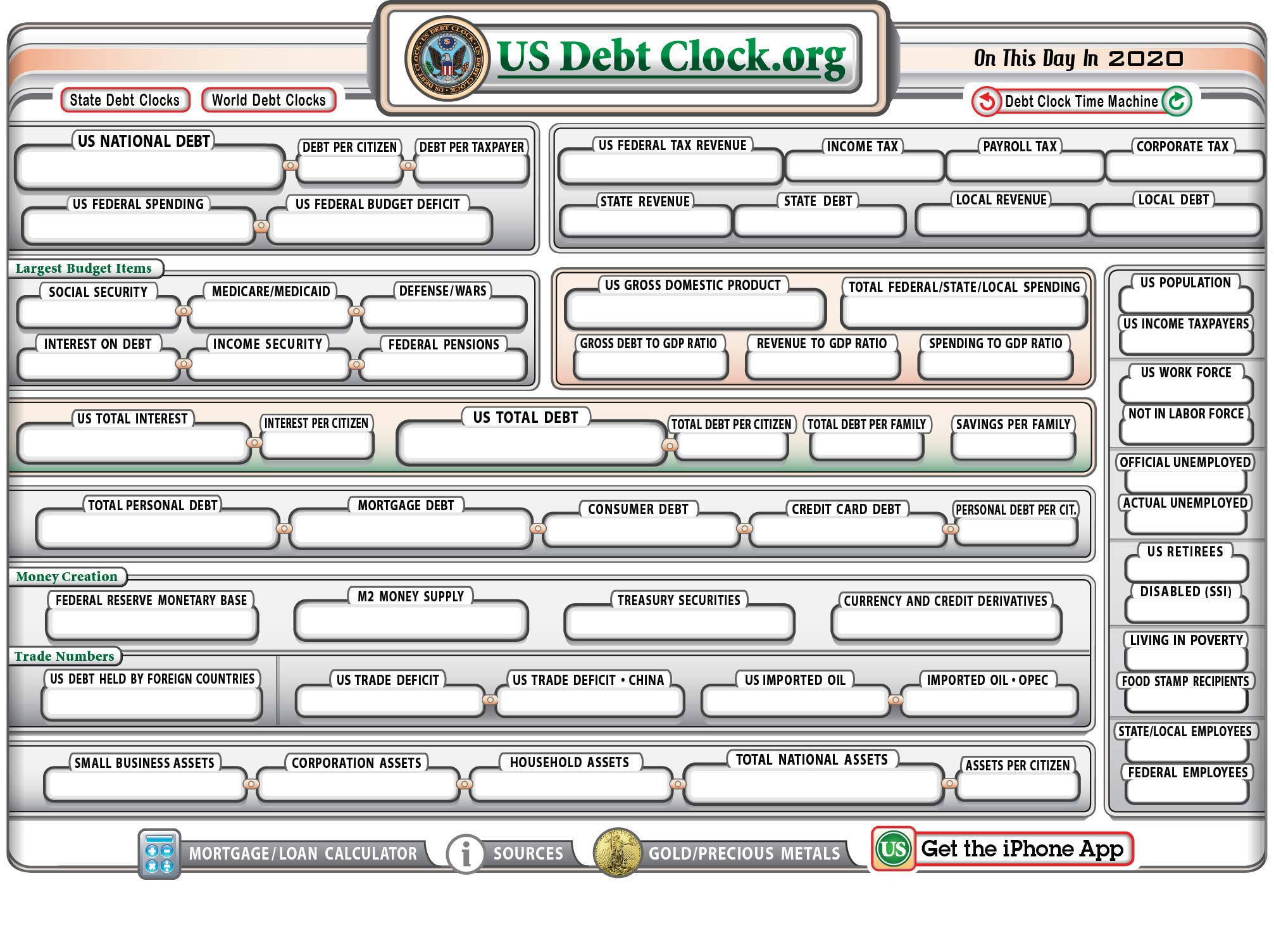

The US Debt Clock operates by displaying real-time data on the national debt and other key economic indicators. The numbers are updated continuously to reflect the latest information from the US Treasury Department. The clock uses complex algorithms to calculate the debt based on government spending and revenue figures.

Key elements of the US Debt Clock include:

- National Debt: The total amount of money owed by the federal government, including debt held by the public and intragovernmental holdings.

- Debt Per Citizen: The average amount of national debt attributed to each US citizen.

- Debt Per Taxpayer: The average amount of national debt attributed to each taxpayer, highlighting the burden on those who contribute to federal revenue.

- Interest on Debt: The cost of servicing the national debt, representing the interest payments made by the government to its creditors.

The clock also provides insights into other economic indicators such as GDP, federal spending, and budget deficits. By examining these figures, individuals can gain a comprehensive understanding of the nation's financial position and the challenges it faces in achieving fiscal sustainability.

Read also:Interior Define A Guide To Personalized Home Furnishings And Design

Importance of the US Debt Clock

The US Debt Clock plays a vital role in raising awareness about the country's financial situation. It serves as a constant reminder of the national debt's impact on the economy and the lives of everyday citizens. By providing real-time data, the clock helps to inform public discussions on fiscal responsibility and government spending.

Some key reasons for the importance of the US Debt Clock include:

- Transparency: The clock increases transparency by providing easy access to crucial economic data, allowing citizens to hold government officials accountable for fiscal policies.

- Education: It serves as an educational tool, helping individuals understand the complexities of the national debt and its implications for the economy.

- Policy Influence: The clock influences policy discussions by highlighting the need for sustainable fiscal policies and encouraging lawmakers to address the national debt.

By shedding light on the financial challenges facing the nation, the US Debt Clock encourages informed decision-making and responsible fiscal management, ultimately contributing to a more stable and prosperous economy.

What Factors Contribute to the National Debt?

The national debt is influenced by several factors, ranging from government spending and tax policies to economic conditions and demographic trends. Some of the primary contributors to the national debt include:

- Government Spending: When government expenditures exceed revenues, deficits occur, leading to an increase in the national debt. Key areas of spending include defense, healthcare, social security, and interest payments on existing debt.

- Tax Policies: Tax cuts and exemptions can reduce government revenue, contributing to budget deficits. Conversely, increasing tax rates or broadening the tax base can help reduce the debt.

- Economic Conditions: During economic downturns, government revenues typically decline due to reduced income and corporate taxes, while spending on social programs may increase, exacerbating the debt.

- Demographic Trends: An aging population can strain government resources, as more individuals rely on social security and healthcare services, leading to increased spending and higher debt levels.

Understanding these factors is crucial for developing effective strategies to manage and reduce the national debt, ensuring a sustainable financial future for the United States.

Impact on Domestic Markets

The national debt has significant implications for domestic financial markets, affecting interest rates, inflation, and overall economic growth. Some of the key impacts include:

- Interest Rates: High levels of national debt can lead to increased interest rates as the government competes with private borrowers for funds. This can result in higher borrowing costs for businesses and consumers, potentially slowing economic growth.

- Inflation: Large-scale government borrowing can lead to inflationary pressures if it results in an increased money supply without corresponding economic growth.

- Investment: High national debt levels can crowd out private investment, as investors may prefer to purchase government securities over corporate bonds or stocks, reducing capital available for businesses to grow and innovate.

By understanding these impacts, policymakers and investors can make informed decisions that promote economic stability and growth, ultimately benefiting the nation's financial markets.

Impact on Global Markets

The US national debt also affects global financial markets, influencing exchange rates, foreign investment, and international trade. Key global impacts include:

- Exchange Rates: High levels of national debt can lead to fluctuations in the value of the US dollar, impacting international trade and investment flows.

- Foreign Investment: As the largest issuer of sovereign debt, the United States attracts significant foreign investment in its government securities. Changes in the national debt can affect investor confidence and influence global capital flows.

- International Trade: A strong US dollar can make American exports more expensive, potentially reducing demand for US goods and services in global markets.

By understanding the global implications of the national debt, countries can better navigate the complexities of international finance and trade, fostering a more stable and interconnected global economy.

How Does the US Debt Clock Affect Investors?

The US Debt Clock can have a significant impact on investors, influencing their perception of risk and shaping their investment strategies. Key considerations for investors include:

- Risk Assessment: High national debt levels can increase perceived risk, prompting investors to reassess their portfolios and consider more conservative investment options.

- Interest Rates: As mentioned earlier, high debt levels can lead to increased interest rates, affecting the cost of borrowing for businesses and consumers, which can impact corporate profits and stock valuations.

- Currency Fluctuations: Changes in the national debt can lead to fluctuations in the US dollar's value, affecting international investments and the competitiveness of US exports.

By staying informed about the US Debt Clock and its implications, investors can make more informed decisions, balancing risk and reward to achieve their financial goals.

The Role of Government Policy

Government policy plays a crucial role in managing the national debt and ensuring fiscal sustainability. Key policy areas that can influence the national debt include:

- Fiscal Policy: Government decisions on taxation and spending can directly impact budget deficits and the national debt. Implementing effective fiscal policies can help reduce the debt and promote economic growth.

- Monetary Policy: Central banks, such as the Federal Reserve, can influence interest rates and money supply, impacting borrowing costs and inflation. Coordinating monetary policy with fiscal policy can help manage the national debt.

- Regulatory Policy: Regulations that promote economic growth, innovation, and competition can help increase government revenues and reduce the debt burden.

By implementing sound policies, governments can manage the national debt more effectively, ensuring long-term economic stability and prosperity.

Potential Consequences of High Debt Levels

High national debt levels can have several potential consequences for the economy and future generations. Some of these consequences include:

- Reduced Fiscal Flexibility: High debt levels can limit the government's ability to respond to economic crises or invest in critical infrastructure and social programs.

- Increased Interest Costs: Servicing a large national debt can consume a significant portion of government revenues, reducing funds available for other priorities.

- Generational Burden: Future generations may face higher taxes or reduced government services as they inherit the responsibility of managing the national debt.

By understanding these potential consequences, policymakers and citizens can work together to address the national debt and ensure a sustainable financial future for the nation.

How Can the National Debt Be Managed?

Effective management of the national debt requires a combination of strategies and policies aimed at reducing budget deficits and promoting economic growth. Some key approaches to managing the national debt include:

- Fiscal Discipline: Implementing responsible spending and taxation policies can help reduce budget deficits and slow the growth of the national debt.

- Economic Growth: Encouraging innovation, investment, and job creation can boost government revenues, reducing the debt burden.

- Entitlement Reforms: Addressing the long-term sustainability of social security and healthcare programs can help manage future spending and reduce the national debt.

By adopting a comprehensive approach to debt management, the United States can ensure a more stable and prosperous financial future.

Public Awareness and Education

Raising public awareness and promoting education about the national debt is essential for fostering informed discussions and encouraging responsible fiscal policies. Key strategies for increasing public awareness include:

- Educational Programs: Developing educational materials and resources to help individuals understand the complexities of the national debt and its implications.

- Media Engagement: Utilizing media platforms to disseminate information about the national debt and its impact on the economy.

- Public Forums: Organizing community events and discussions to engage citizens in conversations about fiscal responsibility and government spending.

By promoting public awareness and education, individuals can become more informed and engaged in discussions about the national debt, ultimately contributing to more effective policymaking and fiscal management.

Future Implications for the US Economy

The US national debt will continue to have significant implications for the country's economy in the future. Key areas of concern include:

- Economic Growth: High debt levels can hinder economic growth by increasing borrowing costs and limiting government investment in critical areas.

- Financial Stability: Managing the national debt is essential for maintaining financial stability and preventing economic crises.

- Global Competitiveness: Ensuring fiscal sustainability can enhance the US's position in the global economy, promoting trade and investment.

By addressing the challenges posed by the national debt, the United States can ensure a more stable and prosperous economic future, benefiting both current and future generations.

Frequently Asked Questions

1. What is the current US national debt?

The current US national debt is constantly changing as it reflects real-time data. To get the most up-to-date figure, refer to reliable sources such as the US Debt Clock or the US Treasury Department.

2. How does the US Debt Clock calculate the national debt?

The US Debt Clock uses complex algorithms to calculate the national debt based on government spending and revenue data from the US Treasury Department.

3. Why is the national debt important?

The national debt is important because it affects economic growth, interest rates, and government spending, impacting the lives of citizens and the overall health of the economy.

4. How can the national debt be reduced?

The national debt can be reduced through responsible fiscal policies, promoting economic growth, and implementing entitlement reforms to manage future spending.

5. What are the consequences of a high national debt?

High national debt levels can lead to increased interest costs, reduced fiscal flexibility, and a generational burden, impacting economic stability and growth.

6. How does the national debt affect interest rates?

High national debt levels can lead to increased interest rates as the government competes with private borrowers for funds, resulting in higher borrowing costs for businesses and consumers.

Conclusion

The US Debt Clock serves as a critical tool for understanding the national debt's impact on the economy and financial markets. By raising awareness and providing real-time data, the clock encourages informed discussions on fiscal responsibility and government spending. With effective policies and strategies in place, the United States can manage the national debt and ensure a stable and prosperous economic future for all citizens.