Choosing the best credit card for groceries is more than just finding a convenient way to pay—it’s about maximizing savings, earning rewards, and enjoying added perks that make your everyday purchases more rewarding. With the ever-increasing cost of groceries, finding the right credit card can help you stretch your budget and even earn cashback or points for other essentials. Whether you're shopping at big-box retailers, local supermarkets, or online grocery stores, the right card can make a world of difference.

In today’s competitive financial world, credit card issuers offer various features such as cashback percentages, rotating bonus categories, and loyalty rewards tailored specifically for grocery purchases. The challenge is identifying which card aligns best with your shopping habits and financial goals. Factors like annual fees, interest rates, and the type of rewards program should all be considered before making a choice. After all, the last thing you want is to pick a card that doesn’t deliver the value you expect.

To simplify your search, we’ve compiled a detailed guide to help you understand every aspect of selecting the best credit card for groceries. From understanding how grocery rewards work to exploring the top-performing credit cards in this category, this article covers everything you need to know. So, let’s dive into the details and find the perfect credit card for your grocery needs!

Read also:The Intriguing Life And Influence Of Dickie Greenleaf A Deep Dive

Table of Contents

- How Do Grocery Rewards Credit Cards Work?

- Why Do You Need a Specific Card for Groceries?

- Top Credit Cards for Grocery Shopping in 2023

- What Should You Look for in a Grocery Credit Card?

- Cashback vs. Points: Which Is Better?

- No Annual Fee Cards for Groceries

- Best Premium Grocery Credit Cards

- How to Maximize Your Grocery Rewards?

- Are Grocery Store-Branded Credit Cards Worth It?

- How Does Your Credit Score Impact Eligibility?

- How to Choose Between Cards Based on Your Shopping Habits?

- Frequently Asked Questions

- Conclusion

How Do Grocery Rewards Credit Cards Work?

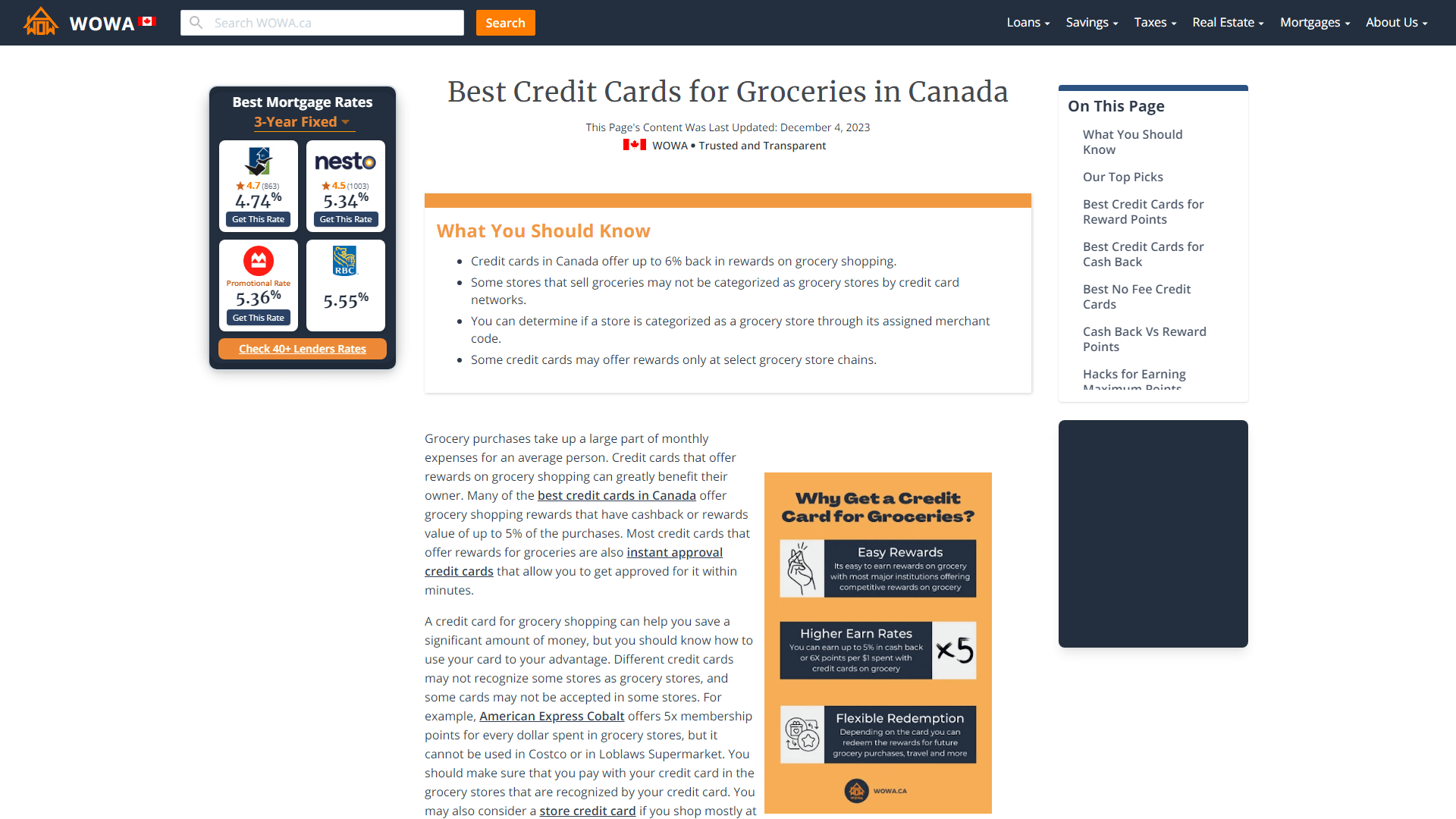

Grocery rewards credit cards are designed to incentivize spending at grocery stores by offering cashback, points, or miles for every dollar spent. These rewards can typically be redeemed for statement credits, travel, gift cards, or other benefits. The key is understanding how the card categorizes "groceries," as some cards may exclude superstores like Walmart or warehouse clubs like Costco.

Here’s a simplified breakdown of how they work:

- Earn Rates: These cards often provide higher earn rates (e.g., 3-6%) on grocery purchases compared to other spending categories.

- Caps and Limits: Many cards have spending caps on grocery rewards. For instance, you might earn 5% cashback on up to $6,000 spent annually, after which the rate drops to 1%.

- Additional Perks: Some cards include benefits like extended warranties, purchase protection, or discounts at specific grocery chains.

Understanding these features can help you make the most of your card and avoid leaving rewards on the table.

Why Do You Need a Specific Card for Groceries?

Groceries are one of the largest recurring expenses for most households, making them an ideal category to target for savings. A specific card for groceries allows you to save money on what you already spend regularly, essentially giving you discounts on your weekly shopping trips.

Some reasons to get a grocery-specific card include:

- Higher Rewards: Standard credit cards often offer just 1-2% back on purchases, whereas grocery-specific cards can offer up to 6%.

- Tailored Benefits: Features like exclusive discounts at your favorite supermarkets or additional cashback on delivery services.

- Budget Optimization: Helps you allocate saved rewards toward other financial goals, such as paying off debt or building an emergency fund.

In essence, a grocery-specific card is a smart financial tool that rewards you for spending on life’s necessities.

Read also:Grace Hopper Celebration A Premier Tech Event For Women In Computing

Top Credit Cards for Grocery Shopping in 2023

Here’s a curated list of the top-performing cards for groceries in 2023:

- Blue Cash Preferred® Card from American Express: Offers 6% cashback on groceries (up to $6,000 annually).

- Chase Freedom Unlimited®: Provides 3% cashback on groceries during the first year, plus other bonus categories.

- Capital One SavorOne Cash Rewards Credit Card: Rewards you with 3% cashback on groceries with no annual fee.

- Amazon Prime Rewards Visa Signature Card: Best for online grocery shopping, offering 5% back on Amazon Fresh and Whole Foods Market purchases.

- Citi Double Cash Card: Earns you 2% cashback on all purchases, making it a versatile choice for groceries and more.

Each of these cards has unique strengths, so choose the one that aligns with your spending habits and financial goals.

What Should You Look for in a Grocery Credit Card?

When selecting the best credit card for groceries, focus on the following factors:

- Reward Rates: Opt for cards that offer at least 3% cashback or equivalent points on grocery purchases.

- Annual Fees: Determine whether the annual fee is offset by the rewards and perks offered.

- Redemption Options: Choose a card with flexible redemption options that suit your preferences.

- Additional Benefits: Look for perks like extended warranties, purchase protection, or travel benefits.

- Spending Caps: Be aware of any limits on the amount of grocery spending eligible for rewards.

By comparing these features, you can zero in on the card that provides the most value for your grocery shopping.

Cashback vs. Points: Which Is Better?

The debate between cashback and points often boils down to personal preference. Cashback is straightforward—it’s like getting a discount on your purchases. Points, on the other hand, can offer greater value if redeemed strategically, such as for travel or high-value gift cards. Consider your lifestyle and redemption goals when deciding which is better for you.

No Annual Fee Cards for Groceries

If you want to save without worrying about annual fees, there are several cards to consider:

- Capital One SavorOne Cash Rewards Credit Card: Offers 3% cashback with no annual fee.

- Chase Freedom Flex®: Earns 5% on rotating categories, often including groceries.

No annual fee cards are ideal for budget-conscious shoppers looking to maximize rewards without added costs.

Frequently Asked Questions

Here are some common questions about grocery credit cards:

- Do grocery cards work for online shopping? Yes, many cards include online grocery stores like Amazon Fresh.

- Are rewards taxable? No, cashback or points are generally not considered taxable income.

Conclusion

The best credit card for groceries can significantly enhance your everyday spending by offering valuable rewards, cashback, and perks tailored to your shopping habits. By understanding your needs and comparing the top options available, you can make a smart decision that maximizes your savings and rewards potential.